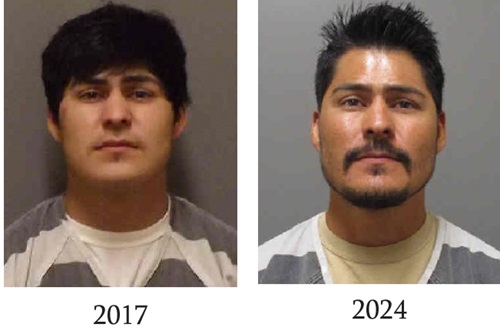

The City of Sioux Center is looking to decrease the city tax rate in the 2024-25 budget. The City Council is considering lowering the city’s portion of the levy rate to $11.114 per $1,000 of taxable valuation, about a .2% decrease. The council reviewed the general fund budget Feb. 15.

The general fund includes:

- Police, fire and ambulance services.

- Public works including streets, streetlights, airport, and snow removal.

- Culture and recreation – parks, trails, library, rec facilities, and arts/recreation programs.

- Economic development.

- General government uses such as finance/accounting and elections.

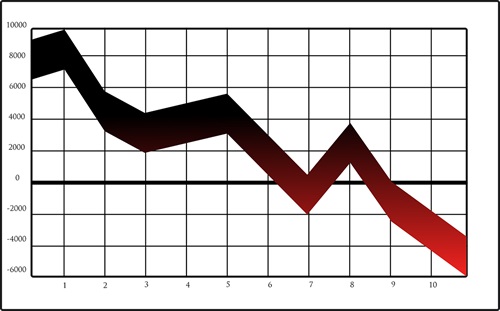

“This is the 15th consecutive year the City tax rate has had no change or decreased. Since fiscal year 2008, the city levy rate has decreased by about 20%,” said Sioux Center Finance Director Darryl Ten Pas. “We see properties here hold and increase their value, plus continued growth of residential and commercial development, so with cost control in our City organization, we can keep the levy down.”

With the City levy decrease as well as a decrease in residential rollback, which is set by the state of Iowa, homeowners will likely see no significant change in their residential City property tax bill even though their home value has likely increased. The City’s portion of a homeowner’s property tax bill is about 33%. The remaining 67% percent goes to the Sioux Center Community School District, Sioux County, and Northwest Iowa Community College.

The next steps in the City budget process include reviewing the utility budget and hosting a public hearing on the property tax levy on March 27. Following that, the council will decide whether to approve the 2024-25 budget in April.

Additional budget highlights:

Utilities contribution

Our municipally-owned utilities are not required by law to pay property taxes, but they still make an annual contribution to the city’s general fund. In this budget the electric, gas and water utilities will contribute 5% of utility sales to the general fund, which has been the typical practice.

Highway 75

Phase 2 of Highway 75 reconstruction begins in 2024. The City and the Iowa Department of Transportation are sharing the costs of this project, with the City covering utility improvements, street lights, engineering, and a portion of paving costs. City funds will come from various sources, including road use tax, local option sales tax, and dollars previously set aside for this project, all which help minimize planned borrowing for the 2024 construction year.

“Highway 75 is our major focus this year,” Ten Pas said. “As we get into Phase 2, this will continue to involve many City departments – with utility work, street lighting, communication, and project planning and administration.”

Emergency Vehicles

In 2024-25, the City is budgeting for a new ambulance and new police vehicle and is making a down payment for a new fire truck. These are part of routine vehicle replacements so emergency responders have reliable vehicles as they respond.

Parks and trails

Potential trail additions and connections are being considered for the 2024-25 year. Rubber mulch is planned to be added to a play area as well.

All Seasons Center

This budget includes resurfacing a western portion of the All Seasons Center parking lot – highly used with Siouxnami Waterpark, the All Seasons Center and ASB Sports Complex. Also, the City will partner with Dordt University and the youth hockey program to purchase a new Zamboni this year.

Streets

The new street sweeper to replace the existing 10-year-old street sweeper is in the budget. The new sweeper will allow for cleaning the new design of Highway 75.

Hotel/Motel Tax

Additional revenue due to voted 2% increase and addition of the Fairfield Inn & Suites will help promote more visits to Sioux Center.

Local Option Sales Tax

About $778,000 in Local Option Sales Tax (LOST) will go into the general fund as property tax relief and $300,000 will be used for Highway 75 work, $150,000 for economic development projects, and $150,000 for trails.